MARKET TRENDS

Why ADCs Are Becoming Oncology’s Most Reliable Trend

Landmark ADC deals from 2023–2024 and new 2025 approvals underscore sustained momentum in targeted cancer care

10 Feb 2025

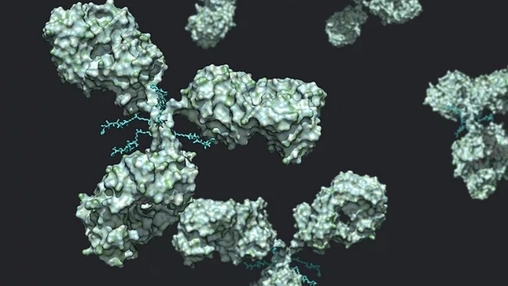

Targeted cancer care in the US continues to advance, with antibody drug conjugates, or ADCs, emerging as a central pillar of oncology strategy. While the pace of large acquisitions has slowed since early 2024, the impact of earlier deals and new clinical data is still shaping investment and research priorities across the sector.

A key moment came in December 2023, when Pfizer completed its roughly $43bn acquisition of Seagen. The deal brought together Pfizer’s global commercial reach and one of the most established ADC platforms, signalling growing confidence among large drugmakers in the long-term value of targeted therapies. Although the transaction is no longer recent, it continues to influence how companies assess scale, integration and returns on scientific innovation.

That momentum extended into early 2024. AbbVie completed its acquisition of ImmunoGen in February, reinforcing investor interest in ADC technology and highlighting ongoing competition for specialised assets. Together, the Pfizer and AbbVie transactions now underpin what is often described as sustained deal activity in the space, even as fewer large public takeovers have followed.

Attention has increasingly shifted to clinical progress. ADCs have reported further advances in solid tumours, notably in breast and lung cancer. Datopotamab deruxtecan received US Food and Drug Administration approval in January 2025, offering fresh evidence that ADC research is translating into new treatment options. Such approvals are supporting the move of ADCs into earlier lines of therapy and wider patient groups.

As the market matures, companies are placing more emphasis on demonstrating value beyond initial trials. Longer-term studies, post-marketing data and presentations at major scientific meetings are becoming more important as drugmakers seek to show durable real-world outcomes. This reflects a broader industry view that innovation must be backed by clear and sustained clinical benefit.

Cost and access remain challenges. ADCs are complex to develop and manufacture, often resulting in high prices that draw scrutiny from payers. In response, manufacturers are investing more in outcomes data and patient support programmes to support reimbursement and broaden uptake.

Looking ahead, targeted cancer care appears set for steady growth rather than another surge in dealmaking. With major acquisitions largely completed and new approvals continuing, ADCs are moving from breakthrough promise to an established part of oncology care.

Latest News

24 Jan 2026

AbbVie’s RemeGen Bet Highlights a Shift in Cancer Strategy19 Jan 2026

Pfizer Moves Deeper Into ADCs With Pivotal Lung Cancer Trials14 Jan 2026

In Precision Oncology, Smart Alliances Are Beating Big Buys8 Jan 2026

Orphan Drug Incentives Shape Next Wave of Cancer Deals

Related News

INSIGHTS

24 Jan 2026

AbbVie’s RemeGen Bet Highlights a Shift in Cancer Strategy

RESEARCH

19 Jan 2026

Pfizer Moves Deeper Into ADCs With Pivotal Lung Cancer Trials

PARTNERSHIPS

14 Jan 2026

In Precision Oncology, Smart Alliances Are Beating Big Buys

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.